MicroStrategy has been in the spotlight in the world of digital finance since deciding to adopt Bitcoin (BTC) as their primary asset.

This technology company not only utilizes Bitcoin as a hedge against inflation, but has also become one of the main supporters of crypto adoption globally.

Here are 10 interesting facts about MicroStrategy’s relationship with Bitcoin that demonstrate their commitment to this digital asset.

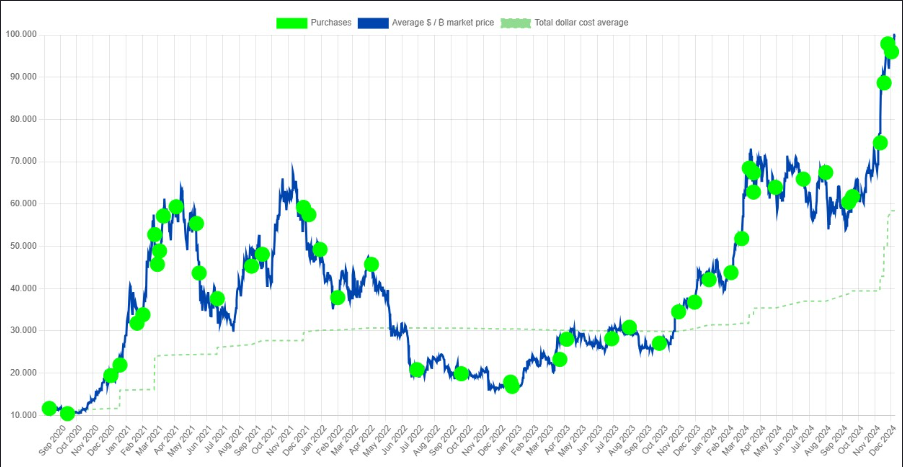

Chart of BTC purchases by MicroStrategy since 2020. Source: SaylorTracker.

10 Facts about the Relationship between MicroStrategy and Bitcoin

1.First Bitcoin Purchase in 2020

In August 2020, MicroStrategy took a bold step by purchasing Bitcoin for the first time with 21,454 BTC. These purchases were made in response to inflation concerns and depreciation of the value of fiat currencies. This purchase was announced on September 17, 2020. This decision was a turning point in the company’s history.

2. Michael Saylor: Vocal Bitcoin Supporter

Michael Saylor, Founder and Executive Chairman of MicroStrategy, has been one of the most vocal voices in support of Bitcoin.

Saylor describes Bitcoin as digital gold and a superior asset for long-term investment. Almost every day he talks about the superiority of Bitcoin in relation to it as a superior asset and has been proven to be able to increase the value of his company’s shares.

Even more recently, in an interview on Market Domination, Michael Saylor called on the US government to sell all its gold reserves and buy Bitcoin instead.

He also suggested keeping 20-25 percent of Bitcoin’s current circulation to strengthen the US’s global reserve currency status and cause economic hardship for competitors holding large gold reserves.

3.Bitcoin Becomes the Main Reserve Asset

MicroStrategy adopted Bitcoin as the company’s primary reserve asset. This move replaces a large portion of their cash reserves, demonstrating a strong belief in Bitcoin’s long-term potential.

4.Creative Funding Strategy

To continue purchasing Bitcoin, MicroStrategy uses various funding strategies. The company issued convertible bonds and took out low-interest loans, most of which were allocated for Bitcoin accumulation.

5.Significant Bitcoin Holdings

Until 2024, MicroStrategy is recorded as having around 402,100 BTC. These holdings make them one of the largest public companies holding significant amounts of Bitcoin. The most recent purchase was announced on December 2, 2024, for 15,400 BTC (US$1.5 billion).

6.US Billion Dollar Investment

Since their first purchase, MicroStrategy has invested billions of US dollars in Bitcoin and their BTC is currently worth US$40.13 billion. Although price volatility is often a challenge, the company remains consistent with their strategy.

7.MicroStrategy Shares Relation to Bitcoin Prices

MicroStrategy’s share price often moves with Bitcoin price fluctuations. This makes their shares a kind of indirect proxy for investors who want exposure to Bitcoin without directly buying the crypto asset.

8.Bitcoin Reporting on the Financial Balance Sheet

MicroStrategy records Bitcoin as an intangible asset on its balance sheet, in accordance with applicable accounting rules.

This provides transparency to shareholders about how companies manage and report their digital assets.

9.Michael Saylor Position Change

In 2022, Michael Saylor stepped down from the CEO position to focus more on the company’s Bitcoin strategy. In his role as Executive Chairman, Saylor has more time to promote Bitcoin and grow its institutional adoption. He even always emphasized that he would not stop buying this one cryptocurrency whatever the price.

10.Bitcoin Education and Promotion

Apart from direct investment, MicroStrategy is also active in education about Bitcoin. They hold various conferences, webinars and interviews to increase the understanding and adoption of Bitcoin, especially among institutions. Not long ago, he even explained his strategy for buying BTC to the Microsoft Board of Directors.

The above facts show how MicroStrategy has taken a unique and visionary position in the crypto ecosystem.

With a bold strategy, strong leadership and focus on education, the company has not only become a major investor but also a pioneer in promoting Bitcoin as an investment tool for the future.

MicroStrategy remains clear evidence of how companies can integrate digital assets like Bitcoin into their business models, despite facing challenges and risks that are not small.

Their strategy continues to be an inspiration for many other companies considering crypto adoption.